Imagine this, you have been diligent to be frugal and save as much as you can. You’ve invested all your savings in index funds for years. It has been a great choice seeing that you didn’t pay any fees to an advisor, and you outperformed more than 65% of active fund managers. The result of all these wise decisions is that you are in the fortunate position to pull the plug on your office job according to the FIRE (Financial Independence / Early Retirement) police.

You decide to keep your index funds because they have catapulted you to your magic number and they have served you so well in the past. What can go wrong?

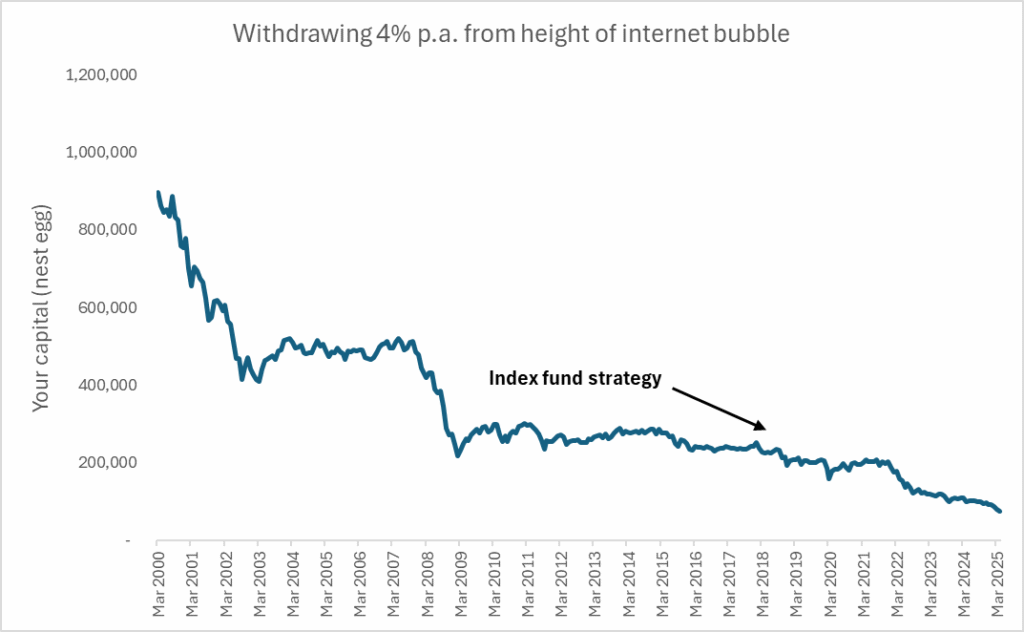

Let’s go back 25 years and show you exactly what can go wrong. It is March 2000, and the stock market is on a massive run. The internet is bringing new efficiencies to the economy and the old rules of investing are not relevant anymore. In fact, it is these internet / technology stocks that allowed you to be in this fortunate position to quit your day job in the first place. You pull the plug and start to withdraw 4% per annum:

Oops! Not exactly a fool proof strategy. You’re done, you’ve been out of the job market for 25 years, and you need to start all over again.

OK, let’s stop the train of depressing thoughts right there. After all, at Freedom Investment Formula, we advocate that the 4% rule is probably too conservative and risk averse for most people and market conditions. You see, the first thing that the FIRE police ignore is where you are in your path to financial independence, i.e. you are not contributing to your money pool anymore, you are about to withdraw. Secondly, market valuations are ignored: at that point in time (March 2000), the market was the most expensive that it has ever been.

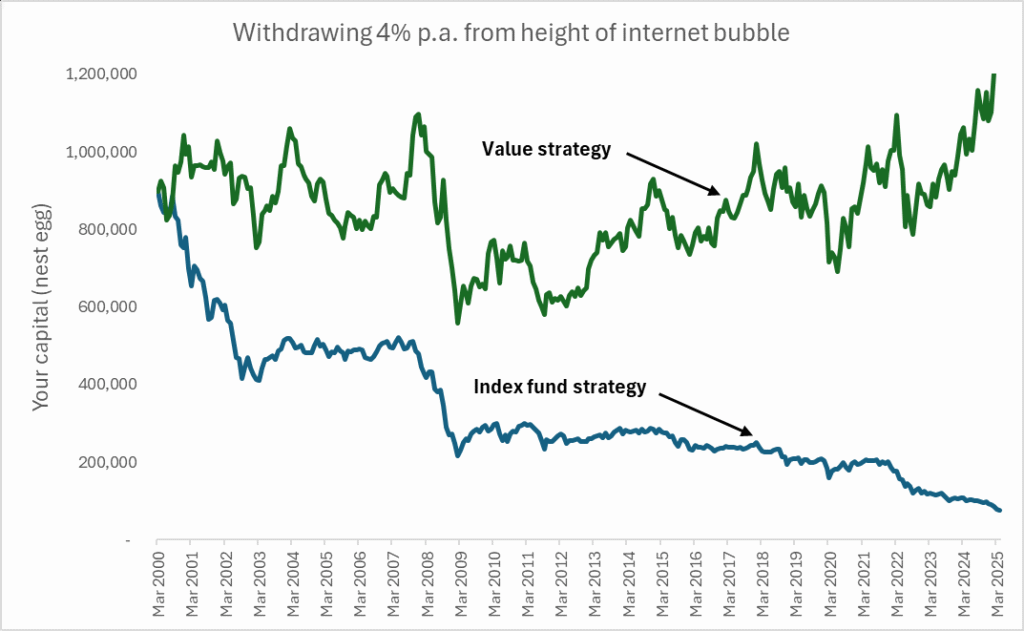

How could we have invested differently? We know that cash will never keep you in retirement in the long run because inflation erodes the buying power of your nest egg. By still being invested 100% in the equity market, but by following a value strategy instead of blindly investing in index funds, the picture could have been different:

Whoa! Not only did a value strategy keep up with inflation after withdrawing 4% per annum (both strategies are adjusted to account for inflation), but your starting capital would also have grown by 36%!

The critics will say that value is very broad and subjective and differs from one value manager to the next. We would agree with that point, and this post is not to argue about what value investing is, it is to show that it is the path or sequence of returns that can save you from financial ruin. After all, the value strategy used in this case is Berkshire Hathaway (Warren Buffet’s company) but stripped of all its outperformance from 1993 to 2025, a whopping 118% penalty that was subtracted.

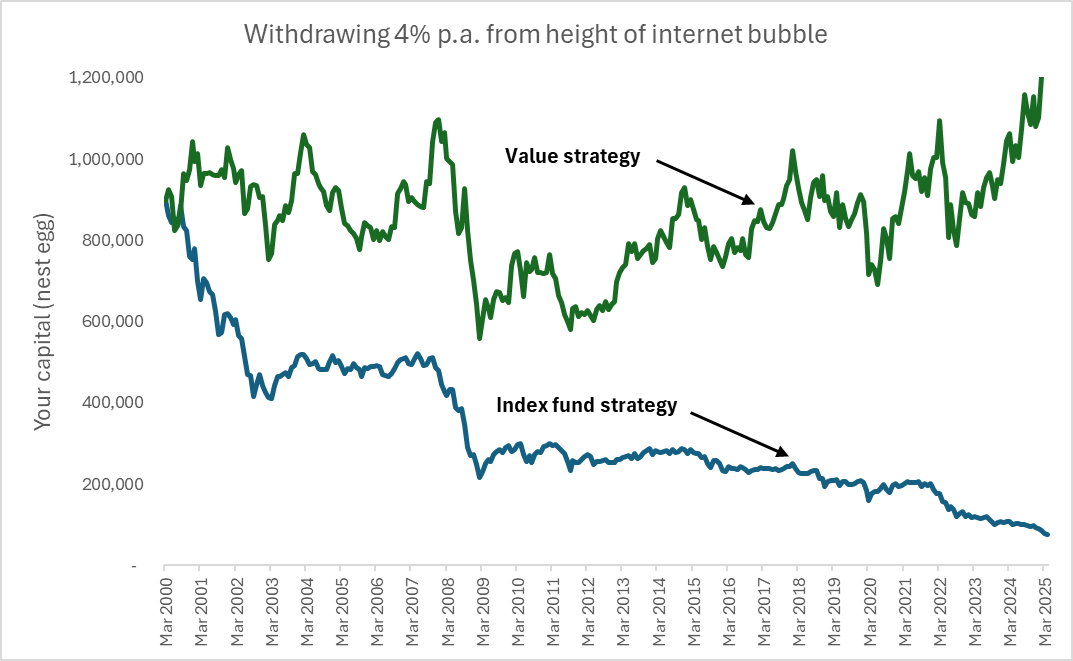

The point that this post would like to get across is that in times of lofty market valuations (like today and March 2000), a value strategy is probably better suited to the investor that withdraws from his pool of money. Nobody can predict how much longer technology stocks will outperform or whether market valuations can go even higher, but over the longer term the likelihood of valuations returning to more reasonable levels, and positioning for such an event, is more prudent for the investor that is withdrawing from his portfolio.

At Freedom Investment Formula we take your path to financial independence, risk tolerance and market conditions into account to reach our combined goal: quit your job as soon as possible as safe as possible.

0 Comments